Best QuickBooks for Contractors: Manage Jobs & Finances

Discover the best QuickBooks for Contractors to manage jobs, track expenses, and streamline your construction business accounting efficiently.

Managing price range and tasks efficaciously is vital for contractors operating in todays aggressive creation enterprise. Whether you are a fashionable contractor, subcontractor, or distinctiveness trade professional, having the right accounting tools could make all of the distinction in streamlining your operations and maximizing profitability.

Thats wherein QuickBooks for Contractors comes in. Designed to fulfill the particular wishes of production specialists, QuickBooks offers tailored functions to manage job costs, tune time, estimate prices, generate reports, and cope with payrollall from one intuitive platform.

In this manual, well explore the satisfactory QuickBooks versions for contractors, spotlight key capabilities, and explain how the software program can guide your construction enterprise in dealing with jobs and finances extra efficiently.

Why Contractors Need Specialized Accounting Software

Unlike conventional small companies, contractors deal with complicated projects that contain multiple process web sites, subcontractors, materials, and timelines. This complexity demands specialized contractor accounting software program that could:

-

Track process-precise charges

-

Monitor challenge profitability

-

Estimate costs as it should be

-

Manage subcontractor bills

-

Comply with tax and hard work policies

Using a normal accounting device or manual spreadsheets can quickly end up inefficient and mistakes-susceptible. QuickBooks enables bridge this gap via imparting robust functions tailored to production and contracting workflows.

Which QuickBooks Version is Best for Contractors?

QuickBooks offers numerous merchandise, however now not all of them are suitable for the development industry. Here are the pinnacle selections for contractors:

1. QuickBooks Desktop Premier Contractor Edition

Best for: Small to mid-sized contractors who need specific task costing and challenge tracking.

The QuickBooks Desktop Premier Contractor Edition is specially designed for the construction enterprise. It gives industry-specific equipment and reviews that permit contractors to tune charges, estimate jobs, and control dealer bills easily.

Key Features:

-

Job value tracking by using item and segment

-

Industry-particular reports (e.G., Job Profitability Summary, Cost to Complete)

-

Estimates vs. Actuals comparison

-

Progress invoicing

-

Purchase order control

-

Subcontractor and dealer monitoring

Pros:

-

Deep task costing functionality

-

Strong reporting tools

-

Robust computer overall performance

Cons:

-

Not cloud-primarily based (unless used with third-birthday celebration hosting)

-

Requires software updates

2. QuickBooks Desktop Enterprise Contractor Edition

Best for: Larger creation companies or companies handling a couple of crews and high undertaking volumes.

QuickBooks Desktop Enterprise is the most powerful version of QuickBooks and is derived with a Contractor Edition preset, providing advanced features perfect for large operations.

Key Features:

-

Up to 40 users

-

Advanced inventory and pricing controls

-

More than 2 hundred customizable reviews

-

Job costing via magnificence, place, and purchaser

-

Advanced reporting with customizable dashboards

-

Integration with payroll, time monitoring, and challenge management tools

Pros:

-

Enterprise-grade equipment and scalability

-

Custom user roles for group control

-

Advanced task and project monitoring

Cons:

-

Higher cost

-

Learning curve for brand spanking new users

3. QuickBooks Online Plus or Advanced

Best for: Contractors who want far flung get admission to, cloud-based totally collaboration, and mobile integration.

QuickBooks Online has come to be a popular option among contractors who're continuously at the flow and need to manipulate projects and financials from the task web site.

While it doesnt offer as many production-particular reports as the laptop versions, QuickBooks Online Plus and Advanced come with stable capabilities that guide fundamental contractor desires.

Key Features:

-

Job and assignment monitoring

-

Time tracking and worker hours

-

Customizable estimates and invoices

-

Mobile access for faraway task control

-

Integration with 1/3-party contractor apps (Buildertrend, Knowify, TSheets, and many others.)

Pros:

-

Cloud-based totally and on hand from any tool

-

Easy to apply and set up

-

Real-time collaboration with group and accountant

Cons:

-

Limited integrated contractor-precise reviews

-

Advanced capabilities require the "Advanced" plan

How QuickBooks Helps Contractors Manage Jobs & Finances

Lets take a closer look at the ways QuickBooks supports contractors in their day-to-day business operations:

1. Job Costing and Profitability Tracking

With QuickBooks for Contractors, you can tune each dollar spent on a processsubstances, labor, subcontractor expenses, and overhead. The software program permits for assigning charges to particular jobs, which helps you calculate profitability and regulate estimates as needed.

Benefits:

-

Avoid underestimating charges

-

Track budget vs. Actuals in real-time

-

Improve future task estimates

2. Estimates and Progress Invoicing

Creating detailed estimates is important in triumphing bids. QuickBooks permits you to generate itemized estimates and convert them into invoices as paintings progresses.

Features:

-

Convert estimates into invoices with a click

-

Invoice clients based on venture milestones

-

Automate routine billing

3. Subcontractor and Vendor Management

Subcontractors are a crucial a part of many creation projects. QuickBooks lets in you to control 1099 providers, music payments, and generate yr-cease tax forms routinely.

Features:

-

Vendor charge monitoring

-

1099 reporting and filing

-

Integration with payroll and TSheets for time tracking

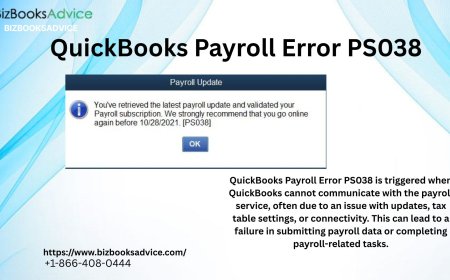

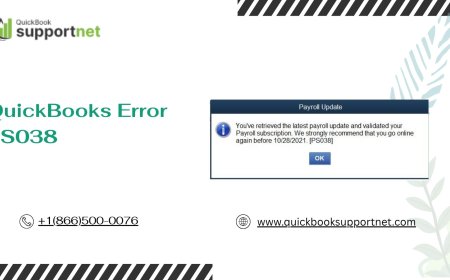

4. Payroll for Job Sites

If you rent people on process sites, coping with payroll manually may be a headache. QuickBooks Payroll integrates seamlessly, allowing you to pay personnel, track hours, and make sure compliance with labor laws.

Benefits:

-

Automatic tax calculation

-

Direct deposit for employees

-

Job-fee allocation of labor prices

5. Reporting and Compliance

Contractors need reviews to expose profitability, music activity status, and plan destiny paintings. QuickBooks gives dozens of construction-precise reviews.

Reports Include:

-

Job Profitability Summary

-

Estimates vs. Actuals

-

Unpaid Bills through Vendor

-

Cost to Complete with the aid of Job

-

Cash Flow Forecasts

Integrations That Enhance Contractor Accounting Software

To amplify the functionality of QuickBooks for Contractors, many users combine it with creation control systems like:

-

Buildertrend: For assignment control and scheduling

-

Knowify: For estimating, time monitoring, and activity costing

-

TSheets (QuickBooks Time): For worker time tracking

-

Procore: For big-scale task coordination

These integrations make certain that your accounting gadget syncs together with your on-site operations for full visibility and performance.

Choosing the Right Version: Key Considerations

When choosing a QuickBooks version, do not forget the subsequent:

-

Company size and boom plans

-

Project volume and complexity

-

Need for far flung access vs. Computing device overall performance

-

Budget and pricing version (subscription vs. One-time)

-

Integration necessities

For small to medium contractors who need depth in process costing, QuickBooks Desktop Premier Contractor Edition is right. For larger firms, the Enterprise Contractor Edition affords scalability. For folks who fee mobility and cloud get admission to, QuickBooks Online Advanced is a amazing preference.

Final Thoughts

The proper accounting software can extensively effect a contractors capability to live profitable, organized, and competitive. QuickBooks for Contractors offers the equipment necessary to control activity expenses, payroll, and financials all in one place.

Whether youre laying foundations or managing multiple crews across process websites, QuickBooks guarantees which youre no longer simply constructing structureshowever building a solid financial foundation to your business.